Union County Bankruptcy Record Lookup

Union County bankruptcy records are processed through the U.S. Bankruptcy Court for the Middle District of Florida, Jacksonville Division. Lake Butler is the county seat, and Union County is one of Florida's smallest counties with a population of about 16,000. All bankruptcy cases from Union County residents go to the federal courthouse in Jacksonville. You can search these records online through PACER, call the free VCIS phone line for basic case information, or visit the courthouse in person to access public terminals. The Union County Clerk of Court handles local civil records that sometimes connect to bankruptcy proceedings, including liens, judgments, and property filings.

Union County Quick Facts

Union County Clerk of Court

Regina L. Parrish is the Union County Clerk of Court. The office is at 55 West Main Street, Union County Courthouse Rm 103, in Lake Butler. Bankruptcy is a federal matter, so those cases go to Jacksonville. But the local clerk handles civil records that can come up during a bankruptcy case. Liens, property records, foreclosure filings, and creditor judgments all pass through this office. If someone in Union County has faced collection actions in state court, those records are kept here.

Contact the Union County Clerk at (386) 496-3711 during business hours, Monday through Friday. The staff can help you search local court records and point you toward the right place for federal bankruptcy filings. The Union County Clerk website has some online access to local records and court information. Federal bankruptcy case files are not in the local system, but state court actions are. Foreclosure cases, debt collection suits, and judgment liens filed against Union County residents can be found through the clerk's office.

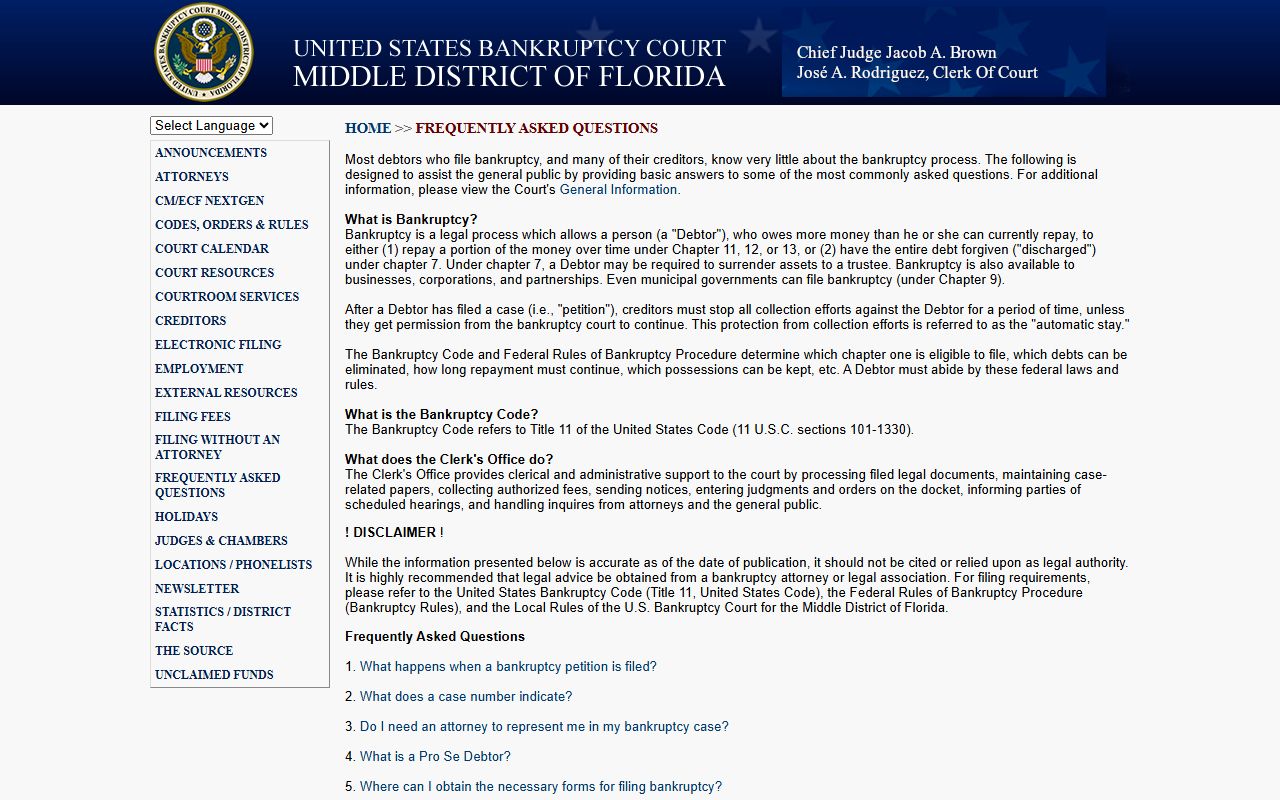

The Middle District of Florida bankruptcy court FAQ page is shown below, available at flmb.uscourts.gov.

The FAQ page covers common questions about filing bankruptcy in the Middle District, including how to search for Union County cases and what forms are needed.

| Clerk | Regina L. Parrish |

|---|---|

| Address | 55 West Main Street, Union County Courthouse Rm 103, Lake Butler, FL 32054 |

| Phone | (386) 496-3711 |

| Website | unionclerk.org |

Bankruptcy Court for Union County

Union County bankruptcy filings go to the U.S. Bankruptcy Court for the Middle District of Florida, Jacksonville Division. The courthouse is at 300 North Hogan Street, Suite 3-150, Jacksonville, FL 32202. Call (904) 301-6490 for court information and scheduling. The Middle District of Florida bankruptcy court website provides local rules, filing procedures, forms, and hearing calendars that apply to Union County cases.

Federal bankruptcy courts work independently from the state court system. The Union County Clerk does not accept or process bankruptcy petitions. All filings go directly to the federal court. Each case gets assigned a trustee to review the debtor's finances. Union County residents attend hearings at the Jacksonville courthouse. Under 11 U.S.C. Section 109, the debtor needs to reside in the district or own property there. Union County is in the Middle District, so the Jacksonville Division is where you file.

Lake Butler is about 55 miles southwest of Jacksonville. Plan for roughly an hour of driving to reach the federal courthouse. Union County residents will need to make this trip for hearings and any in-person court business.

Search Union County Bankruptcy Cases

Three options exist for searching Union County bankruptcy records. PACER provides full online access. VCIS gives you free phone lookups. And the Jacksonville courthouse has public terminals for in-person use.

PACER is the electronic records system for all federal courts. It includes the Middle District of Florida where Union County bankruptcy cases are filed. Register for a free account, then search by debtor name, case number, or Social Security number. Document access costs $0.10 per page, with a $3.00 cap per document. If your quarterly charges stay below $30, they are waived. Union County is small, so the case volume is low, but PACER covers everything that has been filed. Under 11 U.S.C. Section 107, bankruptcy records are public and open to anyone who wants to search them.

The Voice Case Information System, VCIS, is a free phone service available 24 hours a day. Call 1-866-222-8029 to look up Union County bankruptcy cases at any time. The automated system can tell you if a case was filed, the case number, the filing date, the chapter, and the current status. You don't need an account. VCIS is the simplest way to confirm a case exists when you don't need to pull up full documents.

For in-person access, go to 300 North Hogan Street in Jacksonville. Public terminals let you search and view Union County bankruptcy case files at no charge. A valid photo ID is required. Court staff can help you locate specific documents and get copies made.

Filing Bankruptcy in Union County

Union County residents who need to file for bankruptcy usually choose between Chapter 7 and Chapter 13. Chapter 7 eliminates most unsecured debts but may require giving up non-exempt property. Chapter 13 creates a structured repayment plan lasting three to five years. The filing fee is $338 for Chapter 7 and $313 for Chapter 13. You can request installment payments if the full fee is a hardship.

Before you can file, you must complete credit counseling with an approved provider. The U.S. Department of Justice publishes a list of approved agencies for the Middle District of Florida. This is a federal requirement that cannot be skipped. You will need to gather your financial documents: tax returns from the past two years, recent pay stubs, bank statements, and detailed lists of every debt and asset you have. All forms and schedules get filed with the Jacksonville Division court.

Filing activates the automatic stay under 11 U.S.C. Section 362. This immediately stops most collection actions. No more calls from creditors. No lawsuits. No wage garnishments. No foreclosure. The court schedules a meeting of creditors about 30 to 45 days after your filing date. Get all official forms from the U.S. Courts website.

Union County Legal Resources

Handling bankruptcy without help can be difficult. Several organizations serve Union County residents who need assistance. Florida Legal Services provides free legal aid to qualifying low-income individuals statewide, including those in Union County. They can help you evaluate your situation and decide if bankruptcy makes sense.

The Florida Bar runs a lawyer referral service for Union County. A small fee lets you consult with a bankruptcy attorney who knows the Middle District. If you can't afford a lawyer, the court offers pro se resources on its website. Pro se means you handle the case on your own. The Middle District provides guides and sample forms to help self-represented filers from Union County navigate the process. Under 11 U.S.C. Section 727, a successful Chapter 7 case ends with a discharge that releases the debtor from personal liability on most debts. Getting the paperwork right is essential.

Three Rivers Legal Services covers Union County as well. They handle civil legal matters for eligible residents, including debt and housing issues that often lead to bankruptcy considerations.

Not all debts can be discharged. Child support, alimony, student loans, and some tax debts survive bankruptcy under 11 U.S.C. Section 523, regardless of which chapter you file.

Cities in Union County

Union County is one of the smallest counties in Florida. Lake Butler is the county seat and the main town. Raiford and Worthington Springs are other small communities in the area. All bankruptcy filings from Union County go through the Jacksonville Division of the Middle District court, no matter which community the filer lives in.

No cities in Union County meet the population threshold for a separate page. All Union County communities use the same federal courthouse in Jacksonville for bankruptcy proceedings.

Nearby Counties

These counties border Union County. Verify which county you live in before filing. The county you reside in determines the federal court division for your bankruptcy case.