Find Florida Bankruptcy Records

Florida bankruptcy records are federal court documents managed across three U.S. Bankruptcy Court districts in the state. The Northern, Middle, and Southern Districts cover all 67 Florida counties. These courts handle Chapter 7, Chapter 13, and Chapter 11 cases for people and businesses that need debt relief. You can search Florida bankruptcy records through PACER, the federal electronic records system, or call the free Voice Case Information System at 1-866-222-8029 for case details by phone. Each district court keeps its own clerk's office where you can view petitions, docket sheets, and discharge orders at no cost. This page shows you how to find bankruptcy records across Florida.

Florida Bankruptcy Records Quick Facts

Florida Bankruptcy Court Districts

Bankruptcy is a federal matter in Florida. State courts and county clerks do not handle bankruptcy filings. All cases go through one of three U.S. Bankruptcy Court districts. Each district covers a set group of counties and has its own judges, clerks, and court offices. Where you file depends on where you live. The right district for your case is based on your county of residence in Florida.

The Northern District of Florida serves 23 counties across the panhandle and north-central region of the state. Chief Judge Karen K. Specie leads this court. Traci E. Abrams serves as Clerk of Court. The main office is in Tallahassee, with branch offices in Pensacola, Gainesville, and Panama City. You can reach the Northern District at (850) 521-5001 or toll-free at (866) 639-4615. Hours are Monday through Friday, 9:00 AM to 4:00 PM Eastern. The Northern District handles bankruptcy filings for residents in counties like Leon, Escambia, Alachua, and Bay.

The Northern District website has court forms, contact info, and filing guides for Florida bankruptcy cases.

This site covers all 23 counties in the panhandle and north-central Florida.

The Middle District of Florida is the biggest of the three. It covers 35 counties in central Florida. Chief Judge Jacob A. Brown took the bench in October 2025. José A. Rodriguez serves as Clerk. The main office is in Tampa with branch offices in Jacksonville, Orlando, and Fort Myers. Call (813) 301-5162 for help. This district handles bankruptcy records for residents of Hillsborough, Orange, Duval, Pinellas, Polk, and many more Florida counties. Under 11 U.S.C. § 109, any person who lives in or has property in the United States may file for bankruptcy. Florida residents file in the district where they have lived for the greater part of the last 180 days.

The Middle District website lists court locations, FAQs, and filing details for Florida bankruptcy records.

This court covers 35 counties from Jacksonville to Fort Myers.

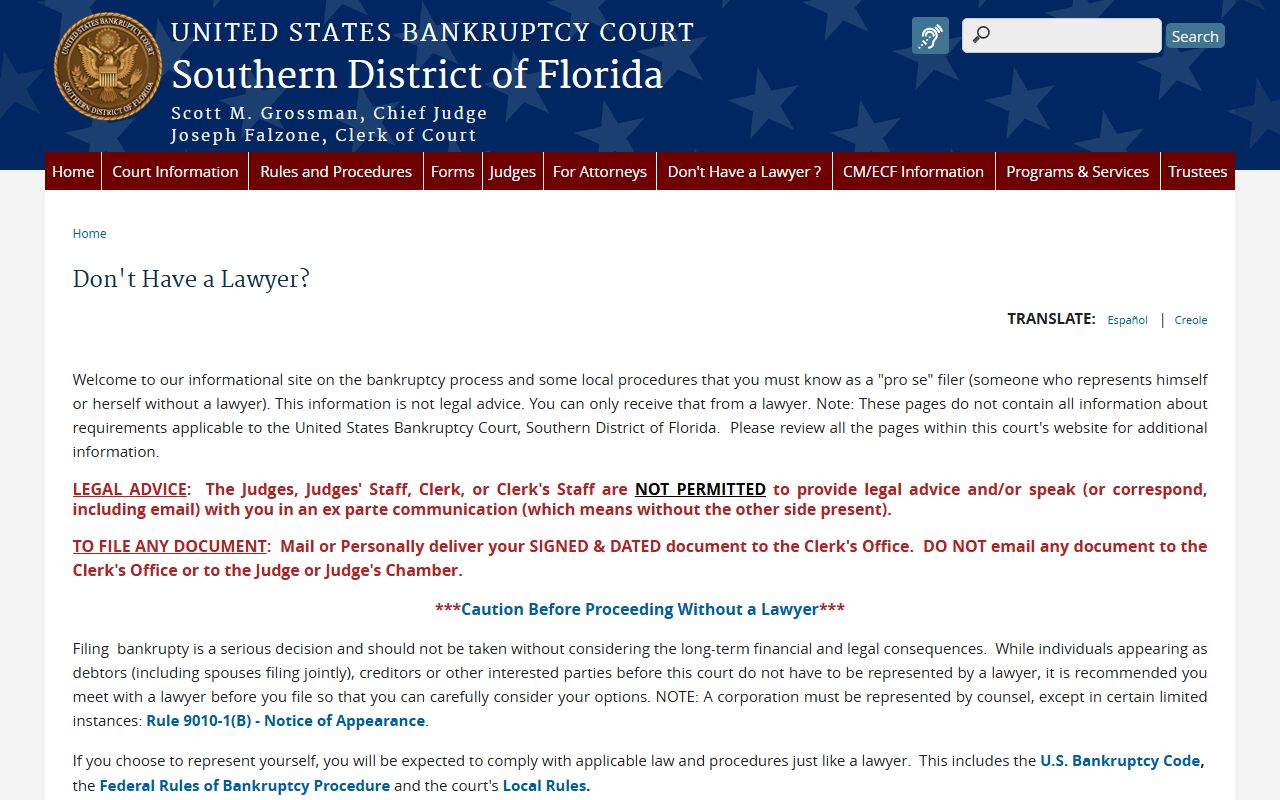

The Southern District of Florida handles 9 counties in the southeast part of the state. Chief Judge Scott M. Grossman leads this court. Joseph Falzone is the Clerk. Offices are in Miami, Fort Lauderdale, and West Palm Beach. Call (305) 714-1800 for the Miami office. This district covers the most densely populated area of Florida and processes a high volume of bankruptcy records each year. Miami-Dade, Broward, and Palm Beach counties make up the bulk of filings in this district.

Visit the Southern District site for court info and bankruptcy record access in south Florida.

Nine counties in southeast Florida fall under this court.

Search Florida Bankruptcy Records Online

PACER is the main way to search bankruptcy records in Florida. This federal system lets you look up case files, docket sheets, and court papers any time of day. Under 11 U.S.C. § 107, bankruptcy filings are public records open to anyone. You do not need to be part of the case to search. PACER covers all three Florida bankruptcy court districts in one system. You can search by debtor name, case number, or Social Security number. Registration is free at pacer.uscourts.gov.

Go to pacer.uscourts.gov to set up your account and start searching Florida bankruptcy records.

PACER gives you access to all federal court records, not just bankruptcy.

PACER charges $0.10 per page for most searches. There is a cap of $3.00 per document. Court opinions are always free to view. If you spend less than $30 in a quarter, all fees are waived. Audio files from court hearings cost $2.40 each. These fees apply to all Florida bankruptcy record searches through PACER. You can also use the Voice Case Information System (VCIS) at 1-866-222-8029. This phone service is free. It runs 24 hours a day, 7 days a week. Press #1 for English, then #3 for Florida, then pick your district.

The PACER pricing page breaks down all costs for searching Florida bankruptcy records.

Fees are waived for users who spend under $30 per quarter.

Each district also has public computer terminals at its clerk's offices. You can view Florida bankruptcy records at these terminals for free. Staff can help you search. No appointment is needed. Just walk in during business hours and ask the clerk to help you find records.

Note: VCIS provides free case info by phone, but you cannot get document copies through the phone system.

Northern District Bankruptcy Court

The Northern District has four offices spread across the Florida panhandle. The Tallahassee Division at 110 East Park Avenue, Suite 100 serves Franklin, Gadsden, Jefferson, Leon, Liberty, Madison, Taylor, and Wakulla counties. The Pensacola Division at 1 North Palafox Street handles Escambia, Okaloosa, and Santa Rosa. Gainesville at 401 SE First Avenue covers Alachua, Dixie, Gilchrist, Lafayette, and Levy. Panama City at 30 W. Government Street serves Bay, Calhoun, Gulf, Holmes, Jackson, Walton, and Washington counties.

The Northern District contact page has phone numbers and email for all four offices.

Email the help desk at CMECF_HelpDesk@flnb.uscourts.gov for filing questions.

The clerk's office cannot give you legal advice. That is a firm rule. Staff can help you find forms and explain filing steps, but they cannot tell you which chapter to file or how to fill out your papers. The Northern District FAQ page covers common questions about bankruptcy filings in this part of Florida. You must redact personal info like Social Security numbers and bank account numbers from all documents before filing. The court takes privacy rules seriously under Fed. R. Bankr. P. 9037.

Check the FAQ section for answers about Florida bankruptcy records in the Northern District.

The FAQ covers topics from filing fees to pro se procedures.

You can get all the forms you need from the Northern District forms page. National and local bankruptcy forms are posted there.

Download and print forms before your visit to the court.

The Northern District locations page shows addresses and hours for all four court offices in Florida.

All offices are open Monday through Friday.

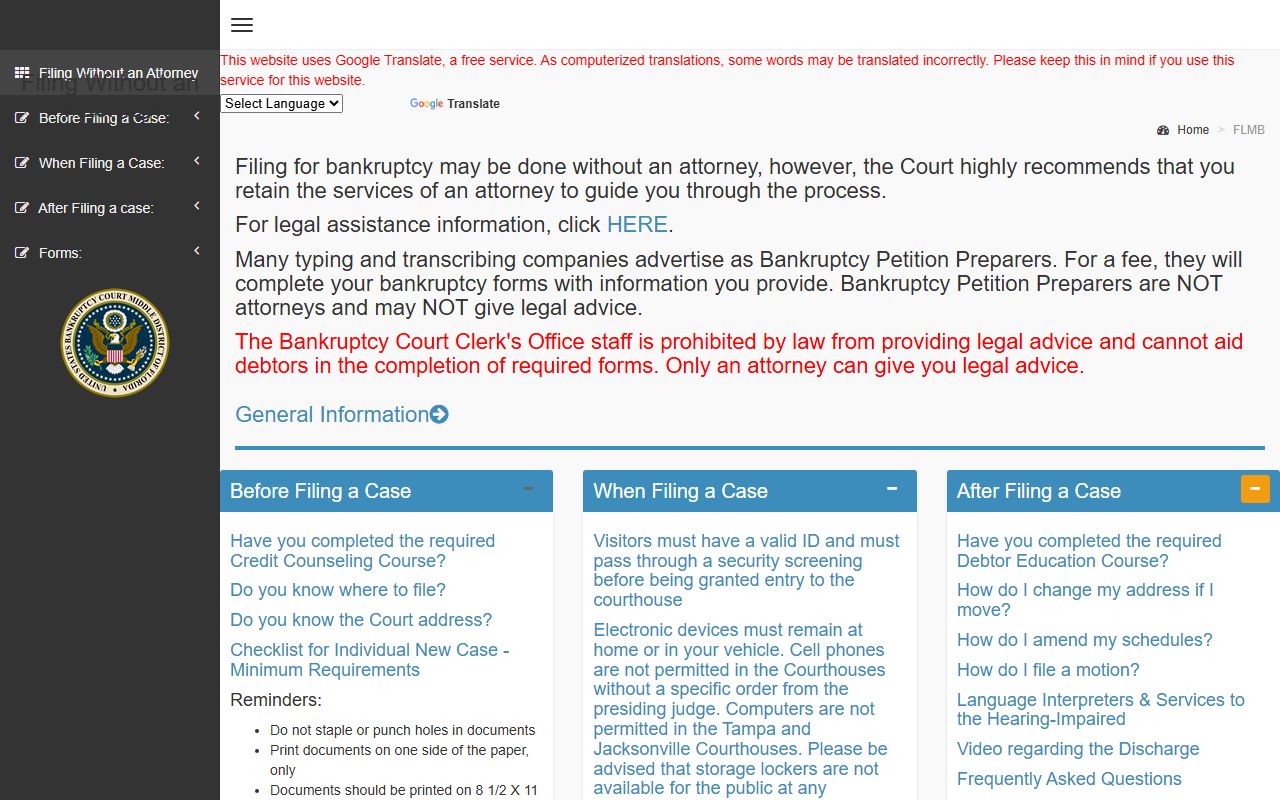

Individuals can file for bankruptcy without a lawyer. The court calls this pro se filing. It is allowed but not recommended because bankruptcy law is complex. Filing mistakes can mean you lose property or other rights. The Northern District pro se page has guides for people who want to file on their own in Florida.

The court provides resources but cannot help you complete your forms.

Middle District Florida Bankruptcy

The Middle District covers the most counties of any Florida bankruptcy court. Its 35 counties stretch from Baker County in the northeast to Collier County in the southwest. The Jacksonville Division at 300 North Hogan Street serves Baker, Bradford, Clay, Duval, Nassau, Putnam, St. Johns, Suwannee, and Union counties. The Orlando Division at 400 W. Washington Street handles Brevard, Flagler, Lake, Marion, Orange, Osceola, Seminole, Sumter, and Volusia. The Tampa Division at 801 N. Florida Avenue covers Citrus, Hardee, Hernando, Hillsborough, Manatee, Pasco, Pinellas, Polk, and Sarasota. The Fort Myers Division handles Charlotte, Collier, DeSoto, Glades, Hendry, and Lee, but has no staffed clerk's office. All filings for the Fort Myers area must go through Tampa.

The Middle District locations page lists all four office addresses and phone numbers.

The Fort Myers office does not accept filings directly.

You can access Florida bankruptcy records at public terminals in the Jacksonville, Orlando, and Tampa offices. There is no charge to view case data on these terminals. Staff are available during business hours to help you search. The Middle District FAQ page answers common questions about case access and filing steps. For the Middle District, the VCIS phone number is 1-866-222-8029, then press #91 to reach the right menu. This is free and runs around the clock.

Visit the Middle District FAQ for details about Florida bankruptcy record searches.

The FAQ covers PACER access, case lookups, and archived record searches.

The Middle District also has a pro se filing guide for people who want to handle their own bankruptcy case in Florida.

Pro se filers must still follow all court rules and deadlines.

Southern District Bankruptcy Records

The Southern District covers nine counties in southeast Florida. It handles a heavy caseload because of the large population in this part of the state. The Miami Division at 301 North Miami Avenue serves Miami-Dade and Monroe counties. Call (305) 714-1800 for that office. The Fort Lauderdale Division at 299 East Broward Blvd. handles Broward, Highlands, and Okeechobee. Call (954) 769-5700. The West Palm Beach Division at 1515 North Flagler Drive covers Indian River, Martin, Palm Beach, and St. Lucie counties. Call (561) 514-4100. Under 11 U.S.C. § 362, the moment a bankruptcy case is filed, an automatic stay goes into effect. This stops most collection actions against the debtor.

See the Southern District locations page for addresses and hours at all three offices.

All three offices are open Monday through Friday, 8:30 AM to 4:00 PM.

The Southern District handles thousands of Florida bankruptcy records each year. You can view cases at public terminals in the Miami, Fort Lauderdale, and West Palm Beach offices at no charge. The Southern District FAQ explains how to access records and what to expect when you visit.

Check the FAQ before visiting to save time.

Bankruptcy forms for the Southern District are posted on their forms page. Both national and local forms are there.

Download forms ahead of time to speed up the filing process.

People who want to file without a lawyer can find guides on the Southern District pro se page. The court strongly recommends hiring an attorney for Florida bankruptcy cases because the law is complex and mistakes can be costly.

Pro se filers still need to meet all requirements and deadlines.

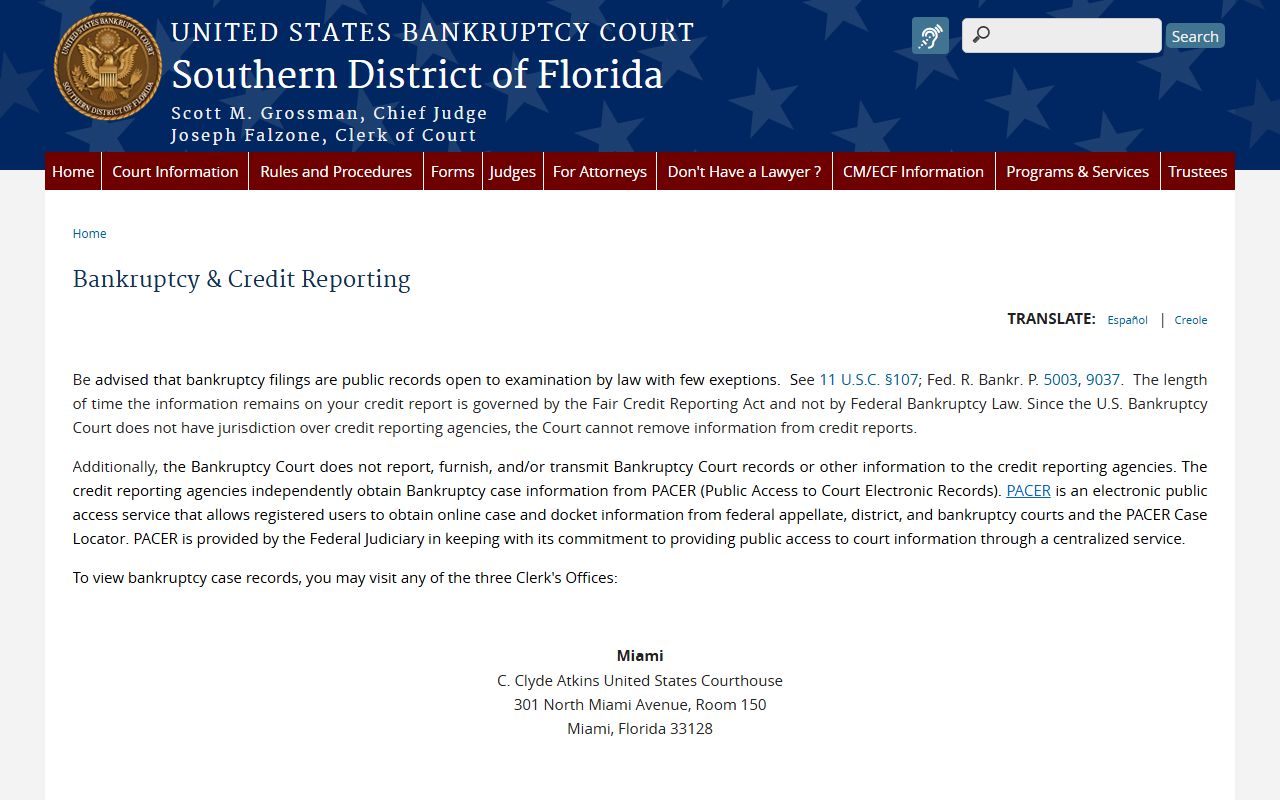

Bankruptcy filings show up on credit reports. The court does not send records to credit bureaus. Instead, credit agencies pull info from PACER on their own. Under the Fair Credit Reporting Act, a Chapter 7 case stays on your report for up to 10 years from the filing date. A Chapter 13 case stays for up to 7 years. The Southern District credit reporting page explains how this works for Florida bankruptcy records.

The court has no power to remove bankruptcy info from credit reports.

Filing for Bankruptcy in Florida

There are three common types of bankruptcy cases filed in Florida. Chapter 7 is a liquidation case. A trustee may sell some of your assets to pay creditors. Most Chapter 7 cases in Florida end with a discharge that wipes out qualifying debts. The filing fee is $338. Chapter 13 is a repayment plan for people with regular income. You make monthly payments over 3 to 5 years. The filing fee is $313. Chapter 11 is mainly for businesses that want to reorganize while keeping the doors open. The filing fee is $1,738. Under 11 U.S.C. § 727, individual debtors who complete a Chapter 7 case receive a discharge of most debts.

Before you file for bankruptcy in Florida, you must take a credit counseling course from an approved agency. This is required by federal law. The course must come from an agency on the U.S. Trustee's approved list. You must finish the course within 180 days before filing. After your case is filed, you also need to complete a financial management course before you can get your discharge. Both courses can be done online or by phone.

The approved credit counseling agency list shows providers available for Florida bankruptcy filers.

You must get a certificate from an approved agency before filing.

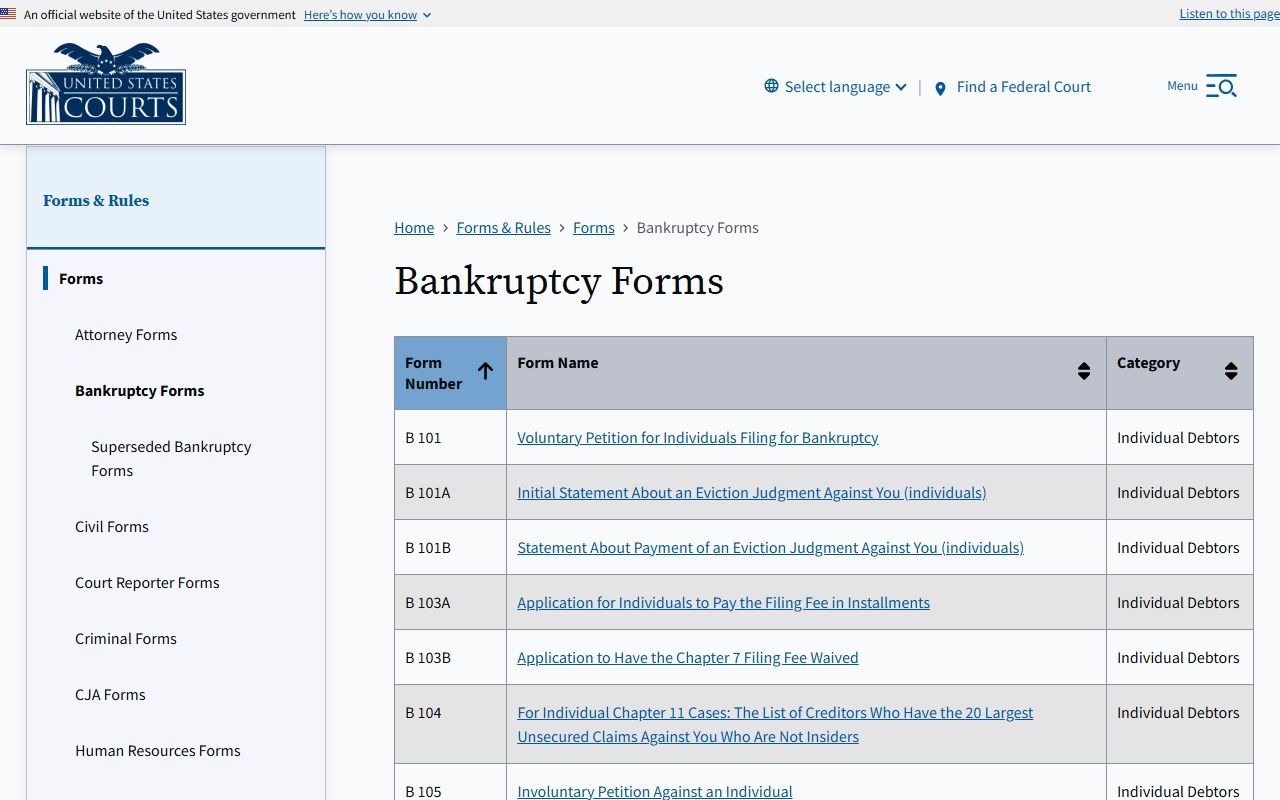

All official bankruptcy forms are available from the U.S. Courts website. These include the petition, schedules, statement of financial affairs, and other required papers. The forms are the same for all three Florida districts, though some local forms vary by court. Under 11 U.S.C. § 523, certain debts cannot be discharged in bankruptcy. These include most student loans, recent tax debts, child support, and alimony.

Download all U.S. Courts bankruptcy forms needed for filing in Florida.

These national forms work for all three Florida bankruptcy districts.

Note: Filing fees can be paid in installments if you qualify, and fee waivers are available for Chapter 7 filers with very low income.

Florida Bankruptcy Legal Resources

Several groups in Florida can help with bankruptcy cases. The Florida Courts system provides general info about state courts, though bankruptcy cases go through federal courts. The state court site is still useful for related matters like foreclosure defense and debt collection cases that tie into bankruptcy filings in Florida.

The Florida Courts website has info on state court matters that may connect to bankruptcy cases.

State courts handle foreclosure and debt cases that often lead to bankruptcy.

The Florida Bar runs a lawyer referral service. Call them to get connected with a bankruptcy attorney in your area. A lawyer can help you figure out which chapter is right for your situation and guide you through the filing process. Many bankruptcy lawyers in Florida offer free first meetings. The Florida Bar can match you with someone who handles cases in your local federal court district.

Use the Florida Bar website to find a bankruptcy lawyer near you.

Many attorneys offer free consultations for Florida bankruptcy cases.

Florida Legal Services gives free legal help to people with low income. They handle cases across the state. If you cannot afford a lawyer for your bankruptcy case, this is a good place to start. They can tell you if you qualify for free help and point you to local legal aid offices in your county.

Visit Florida Legal Services if you need free legal help with bankruptcy in Florida.

Low-income residents may qualify for free legal aid with bankruptcy filings.

Browse Florida Bankruptcy by County

Each Florida county falls under one of the three federal bankruptcy court districts. Pick a county below to find which court handles bankruptcy records for that area, plus local clerk contact info and resources.

Florida Bankruptcy Records by City

Residents of major Florida cities file bankruptcy in the federal court district that covers their county. Pick a city below for details on local bankruptcy resources and court info.